Table of Contents:

1. Introduction to Provisions & Reserves Class 11 Notes

In a running business, it is possible that in future any known or unknown liability may occur. For example,

- The machinery working in that factory will need repairs or renewals at regular intervals of time. For this, business has to pay some amount. It is a kind of known liability.

- In a factory of snacks, it may be possible that in future any worker will get injured while working, and owner has to pay compensation for the same. It can be said to be unknown liability.

To strengthen the financial position and to meet the future liabilities either known or unknown, some portion of the profit should be kept aside. This is done by making provisions and reserves at the time of making final accounts. In this article, we will understand the core concept of Provision and Reserve, in very simple words. Lets start..

2. Understanding “Known Liability” and “Unknown Liability”:

To understand the concept of Provisions and Reserves class 11 notes, it is very imporant to clear about Known and Unknown Liabilities.

Future is unpredictable! No one knows what would happen in future. In a business, there may be occurrence of any known or unknown liability in future. There are many future expenses and liabilities about which the owner of the business would already know. For example – repairs & renewals of any asset (say machinery), depreciation on asset, taxes, loans repayment, etc. These are said to be “Known Liability or Expenses”.

But many expenses or liability occurs unknowingly or unfortunately! For example compensation to be given to a worker as he get injured while working. These kind of incidents are unfortunate and may or may not occur in future. They are said to be “Unknown Liability or Expenses”.

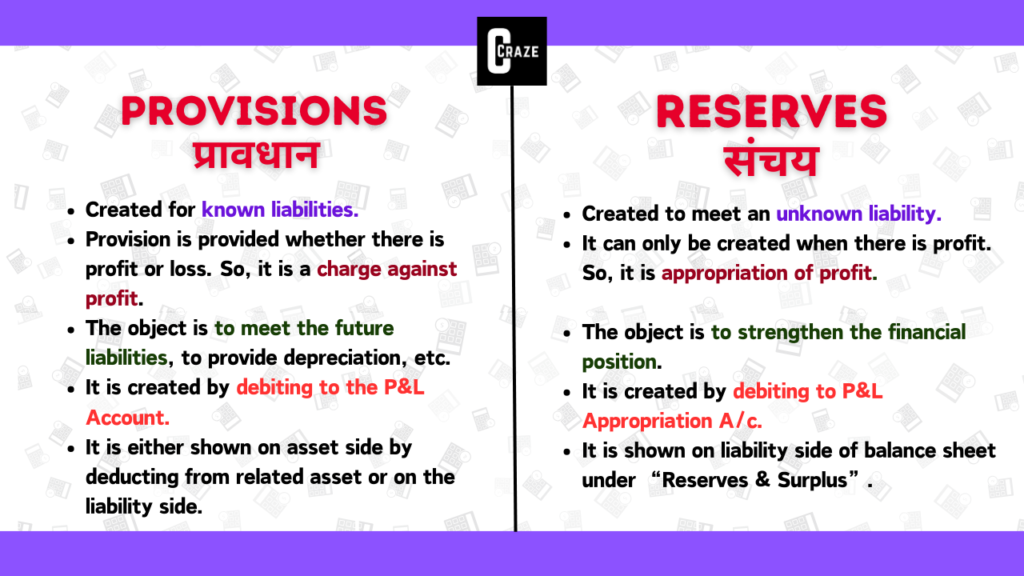

3. Provisions Definition: Class 11 Notes

The amount that are kept aside so as to meet known liability or expenses in future, are ‘Provisions’. Provisions are created to provide amount for known liability. It is charge against profit. Means, either it is profit or loss, it is necessary to kept aside.

As per Companies Act, ‘Provision’ refers to any of the following amounts:

- The amount written off or retained by way of providing for depreciation, renewals or repairs of assets; or

- The amount retained by way of providing for any known liability of which the amount cannot be determined with substantial accuracy.

From the definition it is clear that Provisions are the amount that are kept aside (retained) or written off in order to meet with any known liability or expenses. Example, Provision for Bad Debts, Provision for Discount on Debtors, Provision for Taxation, etc.

Provisions are charged by debiting to the Profit & Loss Account. Net profit can only be ascertained by after debiting all the provisions. And that is why Provisions are charge against profit. Provisions are shown either on Asset side of Balance Sheet by deducting it from related asset or on the Liability side of Balance Sheet.

4. Reserves Definition: Class 11 Notes

Provision definition – The amount that are set aside from the Profit to meet future uncertainties is “Reserve”. There are many expenses or liability that may occur in future unknowingly or uncertainly. To meet such kind of expenses or liability, owners keep some part of profit apart from it as a Reserve.

It should be clear that Reserves can only be maintained when there is profit in the Business. That is why Reserves are Appropriation of Profit. Example, General Reserve, Capital Reserve, Investment Fluctuation Reserve, etc. Reserves are maintained by debiting it to ‘P&L Appropriation Account’. It is shown on Liability side of Balance Sheet under ‘Reserves and Surplus’.

Types of Reserves:

Reserves are classified as follows:

- Revenue Reserve – It is maintained out of day to day profit. It is of two types: i. General Reserve ii. Specific Reserve

- Capital Reserve – It is maintained out of profit gain by selling the assets.

5. Difference between Provisions and Reserves

Checkout our instagram post on this topic in short and simple words! Click Here..

Very helpful👍